Introduction: Understanding Multifamily Supply Dynamics

Amid the surge of new multifamily supply in the market, leveraging construction permits data presents a groundbreaking opportunity for enhancing revenue management strategies. This treasure trove of information, which spans over 70 years, offers unparalleled insights into historical and current trends in housing development. By integrating this data into statistical forecasting models, property managers can significantly refine their understanding of supply dynamics and adjust rent prices with high precision. Unlike conventional metrics that only provide snapshots of present circumstances, this expansive dataset allows for more robust predictions that account for cyclical patterns and long-term shifts.

In an era where big data drives successful business decisions across industries, utilizing freely available construction permit records could be transformative for multifamily revenue management. This resource empowers stakeholders to transcend traditional limitations imposed by local surveys or small-scale databases. As today’s real estate markets become increasingly competitive and volatile, those who harness the predictive power of extensive time-series datasets are likely to lead the way in optimizing rental income while maintaining strong occupancy rates amidst fluctuating supply levels.

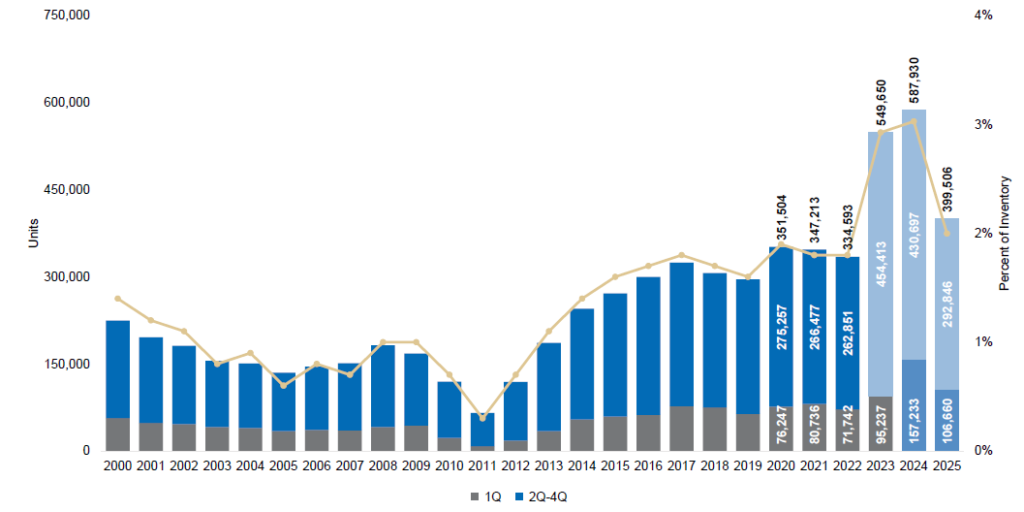

The Rise of Multifamily Construction Permits

The systematic collection of building permits data in the United States has evolved significantly from the 1960s to the present. What began as localized record-keeping by counties and municipalities has grown into a national data infrastructure led by the U.S. Census Bureau and supported by numerous public and private stakeholders. This expansion reflects increased recognition of the critical role building permits play in tracking economic development, urban planning, and housing market dynamics. In the 1960s, building permits data collection was primarily managed at the county and municipal levels. Local governments issued permits to regulate construction activities, ensure building code compliance, and collect fees. However, data was often fragmented and inconsistently reported. The U.S. Census Bureau began centralizing this information through its Construction Statistics Division, launching the Building Permits Survey in 1960. This initiative aimed to create a standardized national dataset to inform policymakers and economists about construction trends.

By the 1990s, building permits data had become a cornerstone of national economic indicators, including the U.S. Department of Housing and Urban Development’s (HUD) housing starts reports. Real estate developers, investors, and researchers increasingly relied on this data to assess market potential and guide investment decisions.

Today, building permits data collection is a collaborative effort involving federal, state, and local entities. The U.S. Census Bureau remains the primary federal agency compiling permits data through its monthly Building Permits Survey and Annual Construction Reports. The survey covers over 20,000 jurisdictions, capturing new residential construction, renovations, and demolitions.

At the local level, county planning and zoning departments play a critical role. Major urban centers like Los Angeles County, Cook County (Illinois), and Harris County (Texas) maintain extensive permitting databases. State agencies often aggregate local data to support statewide infrastructure planning.

Importance of Accurate Forecasting in Real Estate

With accurate forecasting of rental rates in the market, particularly during renewal price modelling, break even analysis of renewal rate and switching costs, a higher degree of price fluency can be achieved

Benefits of Using Construction Permits in Revenue Management

By leveraging construction permit data in a rental rate forecasts, we observed error rates (measured as median absolute percentage error) reduced by 15%-25% across different MSAs. Hence this methodology does produce valuable outcomes for error reduction in markets with a high level of new supply

Dynamic price setting becomes notably efficient when supported by such comprehensive historical data. The ability to anticipate future market conditions—like upcoming excess supply or potential deficits—gives property managers a strategic edge in rent optimization. Instead of reactive pricing adjustments based on immediate competition, multifamily businesses can adopt proactive approaches grounded in empirical analysis. Furthermore, when combined with current market analytics and consumer behavior studies, construction permits data can illuminate previously hidden correlations between new developments and rental demand patterns.

Enhancing Pricing Strategies with Dynamic Data

Stochastic noise filtering and time series forecasting have revolutionized multifamily revenue management by enabling precise, data-driven pricing strategies. These techniques enhance decision-making by filtering out irrelevant market fluctuations and forecasting future rental trends based on historical and real-time data.

- Scalability in Rental Pricing Models

Stochastic noise filtering processes large, complex datasets from sources such as public data for rental pricing and internal property records. This scalability supports advanced multifamily property management tools, ensuring that pricing models remain robust even amid fluctuating market signals. - Customized Lease Pricing Strategies

Time series forecasting enables advanced lease pricing algorithms to integrate critical factors like seasonality, lease terms, and market volatility. Incorporating behavioral analytics for leases allows rental managers to tailor pricing based on past resident behaviors, improving rent optimization while maintaining competitive positioning. - Enhanced Forecast Accuracy

By filtering out random market noise, stochastic models improve the accuracy of data-driven rental pricing decisions. They enable precise trend detection and predictive analysis, reducing uncertainty in future market conditions and optimizing rent-setting strategies. - Real-time Market Responsiveness

Time series forecasting generates real-time rental market insights by continuously analyzing rental demand patterns, competitive pricing, and other market drivers. This helps property managers adjust rent levels dynamically, ensuring cost-effective revenue management and maximizing profitability while minimizing vacancy risks.

Conclusion: Optimizing Revenue with Informed Decision Making

In conclusion, the integration of construction permits data into revenue management strategies offers a significant opportunity to enhance forecasting accuracy and optimize pricing in the multifamily housing market. By leveraging this extensive dataset, which spans over 70 years, property managers and developers can gain valuable insights into supply trends and anticipate market shifts more effectively. This proactive approach enables dynamic price setting that aligns with real-time demand fluctuations, ultimately maximizing revenue potential. The accessibility of this data ensures that even smaller operators can compete on a level playing field with larger entities by making informed decisions based on historical and current trends. As the multifamily landscape continues to evolve, embracing data-driven strategies is not just an advantage but a necessity—empowering stakeholders to thrive in an increasingly competitive environment.

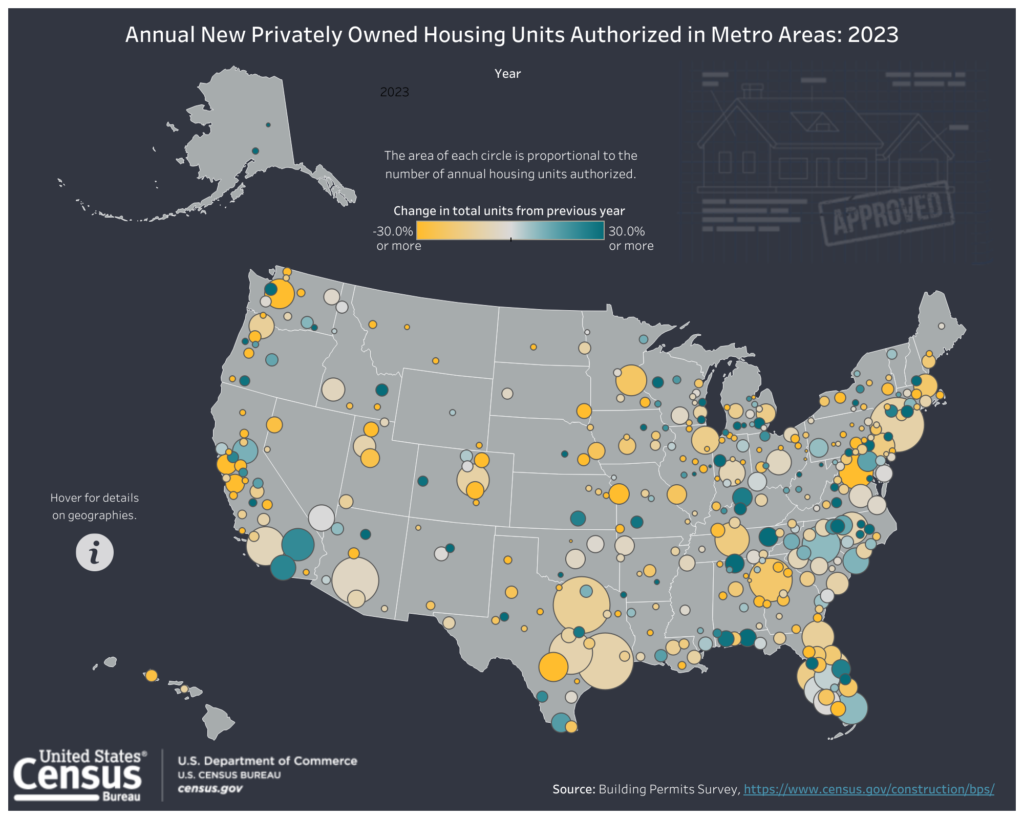

Data exhibits

For further details

https://datavis.census.gov/views/Annual_BPS_MSA_Map/MSADashboard