Overview

While a lot of attention has gone to existing asset classes such as multifamily, single-family rentals and short-term rentals, not a lot is understood about Built to Rent, which is an emerging asset class with strong fundamentals, and few existing assets that are stable and income producing. Hence very little is known about Build to Rent (BTR) in reality.

This comes on the back of late-2022 news of institutional funds such as JP Morgan and JLL Income Property Trust, striking joint venture deals in single-family to invest around $500 MM in BTR as well as scattered site single-family. The inflation resistance was cited as a big focus around residential real estate and SFR and BTR.

In the end, institutional landlords produce vital housing which is in short supply. With the rise in interest rates, home ownership is increasingly unaffordable for Americans, and quality rental housing can indeed fill the gap.

Executive summary

In a webinar organized by Beekin, three institutional investors who have invested in Build to Rent talked about the state of transactions, the underwriting process and the performance of their existing BTR product.

- There is a difference in nomenclature between Build for Rent, where the product was built by a developer for an institutional operator, and Built to Rent, where the institutional investor also took development risk for a higher return

- Homebuilders are building to capitulate to sell homes to BTR, although 90-95% of product profile does not match what is suitable for Build to Rent

- About 10-15% rental premium is being observed on average over scattered site single-family rentals, with an additional premium for bedrooms, recently exacerbated by work from home. The premium is due to newer vintage, professional management and consistent product.

- Rising interest rates were cited as a key concern to transaction and uncertainty, followed by land and permitting risks cited by the audience as an area of concern impeding the growth of BTR

- Policy risk exists at a county level and can be priced in, like other risks such as planning, permits and construction risks. It is deterministic and requires local research. National policy issues are the more important ones to focus on

An institutional audience focuses on the asset class

Attracting over 100 pre-eminent participants, the majority of webinar attendees were institutional investors and developers, potentially looking for answers to underwriting and demand questions from three eminent operators and investors in BTR.

The panelists covered a few key areas:

Changes to underwriting due to interest rates

Homebuilders are increasingly looking to BTR operators to help them with products available for sale, as well as recent construction starts. Large discounts are being offered by both national and regional builders in order to transact.

With interest rates rising, the loan-to-value on deals has fallen to make the mathematics work and transactions have paused. This is due to the environment of rising interest rates. Due to greater volatility, fewer deals are done as the market is moving quite quickly.

Per Geoffrey Kristof, macroeconomically, the present value of future cash flows are worth less due to higher discount rates. That means that whereas in a (previous) low-rate environment deals with first deliveries far off in the future (<3 years delivery) would converge in pricing on an asset that’s stabilized already. Now, no one will be paying top dollar for an asset that will stabilize in three years. Due to a risk premium expansion and a greater compensation demanded per unit of risk by the market, there is a focus on core markets, and fewer riskier projects will be undertaken.

“Long term, it’s going to drive up the cost of housing both on a rental perspective and purchasing a home. A year or two years in the future, many of these builders that are slowing down are starting to stop construction or development. When the pendulum swings the other way, interest rates go down a little bit, that’s going to create even a smaller supply of housing, affordable housing. And it’s going to take us many years to recover. “

Bruce McNeilage, Founder and CEO of Kinloch Partners

Insights on rental housing product required for BTR

Horizontal multifamily is different to BTR, which typically has more bedrooms. The premium for 4 over 3 bedrooms increased, and more construction was geared towards 4 rooms versus apartments which only have 1-2 bedrooms.

Stable demand thesis

As demand for apartments is seeing a big dip, BTR is starting to perform similarly to single-family rentals. This is due to the tenant demographic who choose houses over apartments. BTR is under supplied in areas where tenants are demanding better quality product and hence it still earns a rent premium over single-family whilst representing the institutional premium of multifamily (over condos) but with the lower volatility in cash flow represented by single-family homes.

Tenant profile

‘Historically, Build for Rent tenants have a very high household income. It used to be $120,000 on average. I think now it’s pushing $130,000 average. And so it’s just much stickier tenants. But still for a single family rental compared to multifamily, you have a higher tenancy rate. For Build for Rent it’s about five and a half year average resident tenure. So you’re really not dealing with the risk of having to find a new tenant every single year.

Audrey Carlson, Director of Asset Optimization and Design at SVN|SFR Capital Management

Outlook for 2023

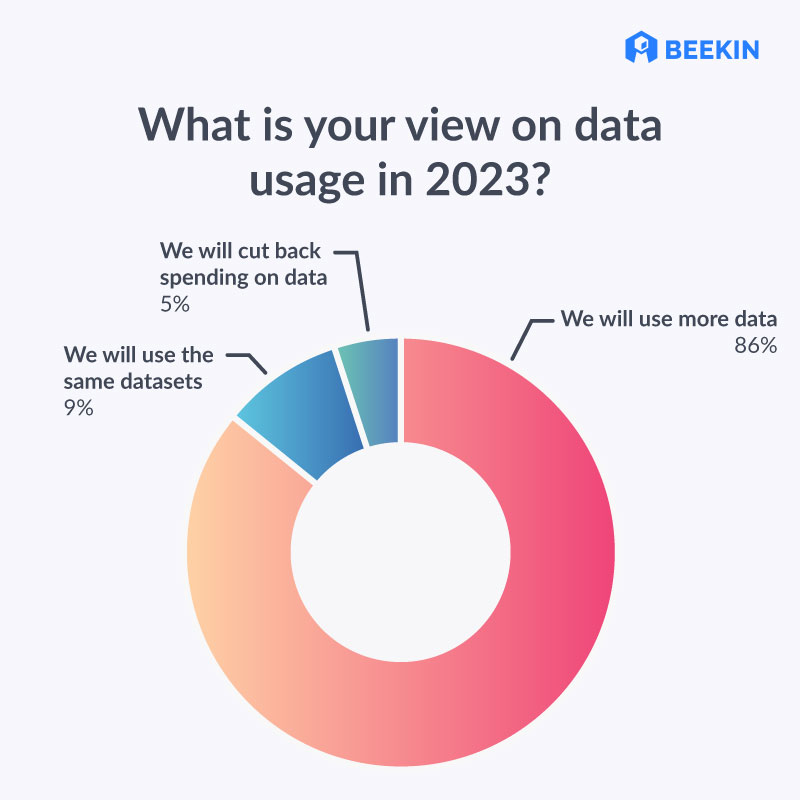

As transactions have slowed down and deals are harder to underwrite, all three players commented on the need to be more forensic around market selection, rent premiums and configuration of product while building BTR communities. They also averred that their consumption of data would increase in 2023 as they believed in data to make better decisions through this crisis

Increased demand for data

‘(BTR) is a highly inefficient market. It’s both highly inefficient and one where there’s an enormous amount of data out there. A lot of these nuances such as the type of tenant , location, are not appropriately priced in. Appropriately looking at the data and harvesting that data in order to make decisions is, I think, crucial to make sure that you’re able to truly weather it down’

Geoffrey Kristof, Head of Single-Family Rental at Asia Pacific Land (APL Group)

Data spend in 2023