Arkansas : The Land of Opportunity

Multifamily operators in secondary cities face several financing challenges compared to their counterparts in primary markets. Some key pain areas

- Higher lending requirements – Lenders typically demand higher debt service coverage ratios, lower loan-to-value ratios, and more substantial reserves for properties in secondary markets.

- Limited lender options – Fewer regional and national lenders actively finance deals in secondary markets, resulting in less competition and potentially less favorable terms.

- Risk perception premiums – Capital providers often charge higher interest rates to compensate for the perceived additional risk of secondary markets.

- Market volatility sensitivity – Secondary markets can experience more dramatic swings in occupancy and rental rates during economic downturns.

- Economic base concerns – Lenders worry about markets dependent on a limited number of employers or industries.

Using data from Beekin same-store rental indices, we analyze secondary cities around the country and compare them to the primary MSAs in the state. This helps understand multifamily investment opportunities in these cities and the volatility inherent in these markets.

In Arkansas, secondary cities are typically understood as urban centers that aren’t as large or dominant as Little Rock (the primary city and state capital) but still play important economic, cultural, or regional roles. Here’s a list of top secondary cities in Arkansas, based on population, regional importance, and economic activity:

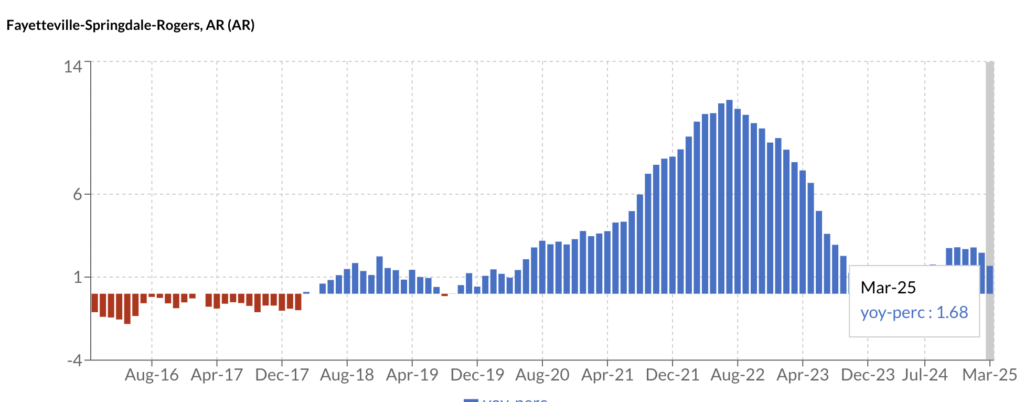

1. Fayetteville-Springdale-Rogers

- Population: ~210,000 combined (growing metropolitan area)

- Known for: University of Arkansas, Walmart corporate presence, logistics

- Why it matters: Economic engine of Northwest Arkansas with strong job growth and tech presence

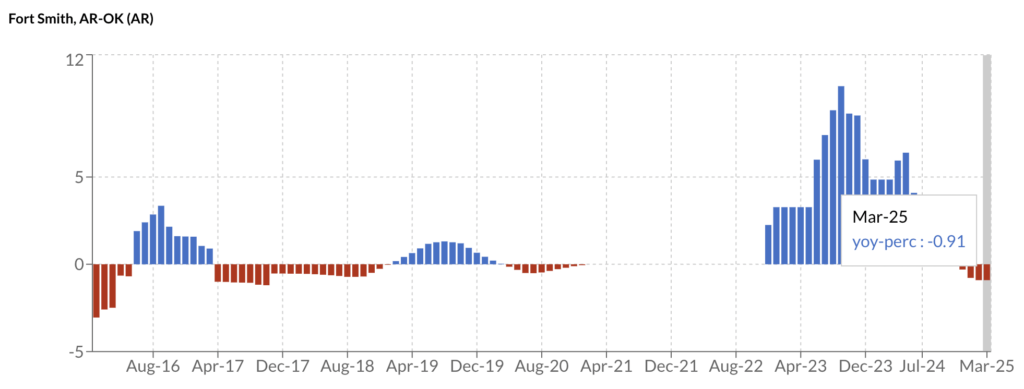

2. Fort Smith

- Population: ~88,000

- Known for: Manufacturing, logistics, healthcare

- Why it matters: Important border city with Oklahoma and regional commercial hub

3. Jonesboro

- Population: ~78,000

- Known for: Arkansas State University, agriculture, healthcare

- Why it matters: Regional center for Northeast Arkansas with strong agricultural ties

4. Hot Springs

- Population: ~38,000

- Known for: Tourism, retirement community, healthcare

- Why it matters: Historic tourist destination with national park and thermal waters

5. Pine Bluff

- Population: ~41,000

- Known for: Agriculture, manufacturing, University of Arkansas at Pine Bluff

- Why it matters: Important city in the Arkansas Delta region

The same-store indices contain rent index values for several Arkansas MSAs. The MSAs included in this analysis from the Beekin same-store rent indices are:

- Fayetteville-Springdale-Rogers, AR

- Fort Smith, AR-OK

- Jonesboro, AR

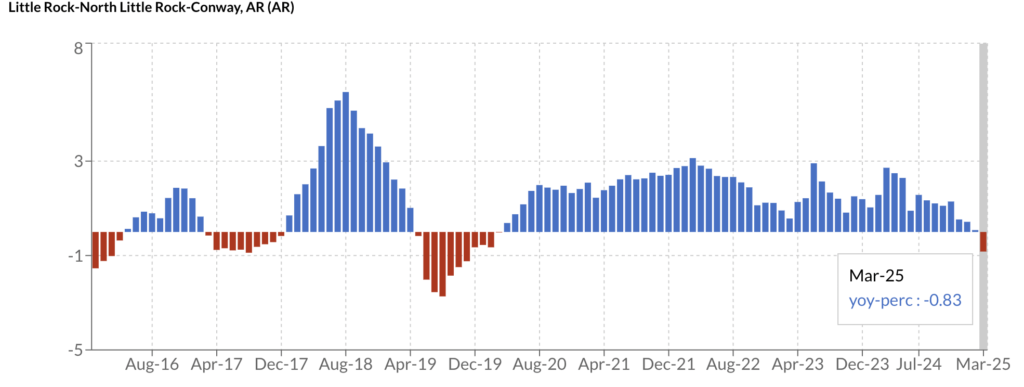

- Little Rock-North Little Rock-Conway, AR (used as the primary market benchmark)

- Hot Springs, AR

🏙️ Secondary Cities: A Second Look at Arkansas

Multifamily operators in Arkansas’s secondary cities face a unique landscape compared to the state’s primary metro, Little Rock. While Little Rock leads in size and economic diversity, cities like Fayetteville-Springdale-Rogers have posted impressive rent growth with varying levels of volatility.

Using data from Beekin same-store rental indices, we analyze key Arkansas markets over the last decade to assess opportunities and stability in multifamily housing.

📊 10-Year Analysis — Arkansas Secondary MSAs vs. Little Rock

| MSA | % 10 Year Rent Change | Peak Rent Index | Peak Rent Period | Standard Deviation | Volatility Score | Max-Min Range |

| Little Rock | 10.5% | 1.13 | Jul 2024 | 0.042 | 3.9% | 13.2% |

| Fayetteville | 27.2% | 1.27 | Aug 2024 | 0.096 | 8.7% | 29.1% |

| Fort Smith | 10.8% | 1.09 | Jul 2024 | 0.029 | 2.9% | 12.5% |

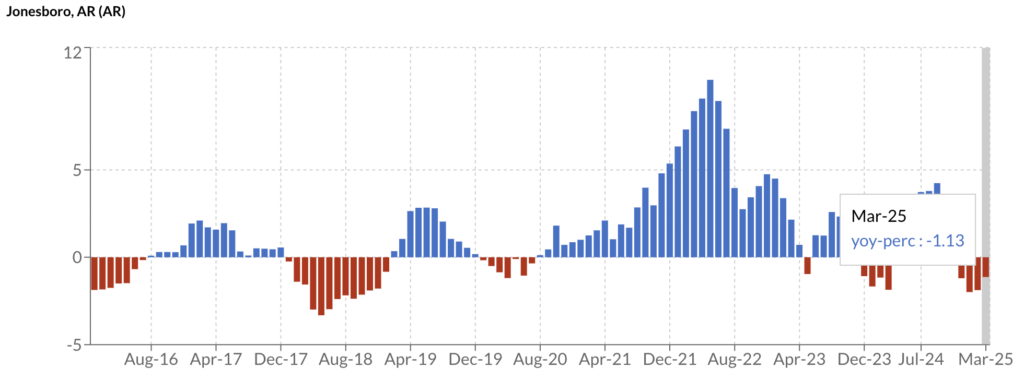

| Jonesboro | 14.5% | 1.15 | Jun 2024 | 0.047 | 4.5% | 17.5% |

| Hot Springs | 1.0% | 1.01 | Jun 2023 | 0.005 | 0.5% | 1.0% |

Volatility Score = Standard Deviation / Average Rent Index

|  |

|  |

🔍 Key Takeaways: Where Are Rents Most Dynamic?

1. Growth vs. Volatility

- Fayetteville-Springdale-Rogers led the state in absolute rent growth (27.2%) and had the highest peak rent index (1.27), significantly outperforming Little Rock (10.5%).

- This Northwest Arkansas metro also showed the highest volatility (8.7%), suggesting more dynamic market conditions.

2. Fort Smith and Jonesboro

- Jonesboro showed moderate growth (14.5%) with relatively low volatility (4.5%), outperforming the capital region.

- Fort Smith had growth (10.8%) similar to Little Rock but with lower volatility (2.9%), suggesting a more stable market.

3. Hot Springs

- Hot Springs showed minimal growth (1%) and extremely low volatility (0.5%), making it the most stable but slowest-growing market.

- This stability may reflect its established tourism and retirement economy.

4. Market Stability

- Fort Smith offers stability over speed, with lower peaks and less dramatic shifts.

- Fayetteville-Springdale-Rogers brings higher returns but comes with higher price swings, indicative of its rapidly evolving economy driven by corporate and university presence.

📈 Final Thoughts

Secondary markets in Arkansas present a diverse landscape for multifamily investors. The Fayetteville-Springdale-Rogers area stands out dramatically from other parts of the state, behaving more like a primary market with robust growth. For multifamily investors and operators, the trade-off between rent growth and volatility is clear:

- Fayetteville-Springdale-Rogers is appealing for those seeking appreciation with some tolerance for market swings, driven by Walmart’s corporate influence and the University of Arkansas.

- Fort Smith provides steadier, lower-risk environments with more modest returns.

- Jonesboro, with Arkansas State University’s influence, presents an interesting middle case of moderate growth with relatively low volatility.

See you in the next Market.