Customer loyalty management for apartments and single family homes is here. Meet WILSON

Business and life is a series of probabilistic outcomes. Death, marriage, and even job satisfaction. We prefer not to measure and optimize these probabilities all the time, but sometimes.

Likewise, in business, measuring outcomes allows us to predict them better. Without measurement, we can not optimize. See below a quote from the father of marketing.

Now – Why does this matter to any investor in an apartment or a home? Because the lease with a renter has an definite outcome, to stay or not to stay. And in managing that single event, a lot of money can be made or lost.

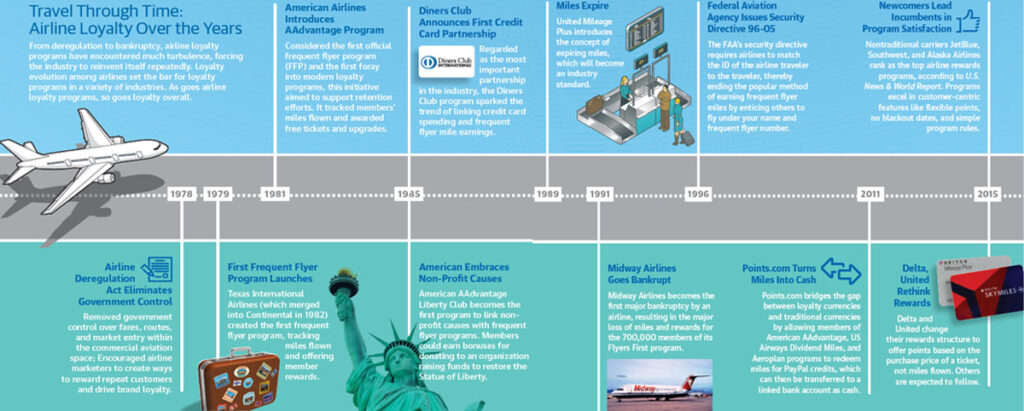

With that context, we explore an emerging topic in apartment and single family home rentals: Retention and Loyalty. And it’s not new, it has been around for 40 years in airlines and hotels, transforming both those industries.

23 years of expiring miles: Airline Loyalty

With the pervasiveness of the internet, acquisition of new customers became harder. Hence the value of loyalty has increased further in both airline and hotels, sectors where transactions are mostly online.

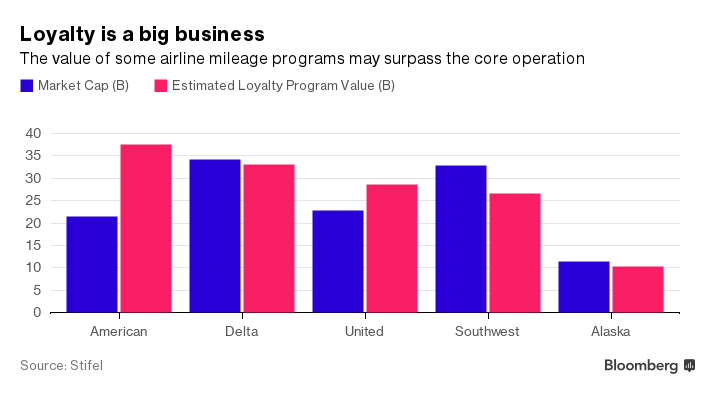

To give you an idea – in the hotel industry, Booking Holdings and Expedia control 95% of the OTA market which places a floor on cost of customer acquisition for any hotel company. Similarly, aggregators like Zillow, Apartments, Google are key to driving new traffic to any property.

Enter Loyalty. Big. Business.

In following the customer journey, we unearthed what the modern loyaltyTech stack in housing looks like:

- Digitization of the resident experience: Resident-focused apps

- 360 degree view of customers: What amenities they like, what smarthome appliances they use etc.

- Customer relationship management: CRM tools to engage prospects and follow-through the lifecycle

- Customer data platform: This is a platform which includes transactional data and reference data, but has not caught up in multifamily or SFR

- Loyalty products: Amenity plans, Concierge services and similar comprise this stack

- Repair experience management

- Customer satisfaction measurement and tracking

- Resident financial incentives

WILSON allows you to connect the dots, harness both transactional data and reference data for customers. In simple english, you can understand payments, work orders, income, FICO, rents and see if a resident is happy, sticky or not

And why WILSON?

Wilson Jerman was a butler to 11 US Presidents. WILSON can be your data butler, as you look to understand your customers better.