TLDR: Risk-return goes in tandem. When interest rates rise, investors want higher-yielding instruments. To make up for this, real estate prices have to fall or rents have to rise. The former looks likely in the coming months as rents start to soften.

If you have been burned by crypto, it is important to reflect and pause on the broader context.

Risk and return go hand and hand, and there are no free lunches. It is also vital to think about portfolio allocation, future investment strategies and how real estate plays into it.

Per Bloomberg, in an environment where inflation persists, investment firms are rotating into bond investments with a higher coupon. Capital gains or increased value in a zero yield environment, income matters more in a high rate environment

Does real estate represent a high-return investment in a high-inflation environment?

Per NAREIT research, comparing REIT returns(through 2021) to private real estate investments (measured via ODCE Index which tracks open-ended real estate funds), REITs have outperformed private real estate.

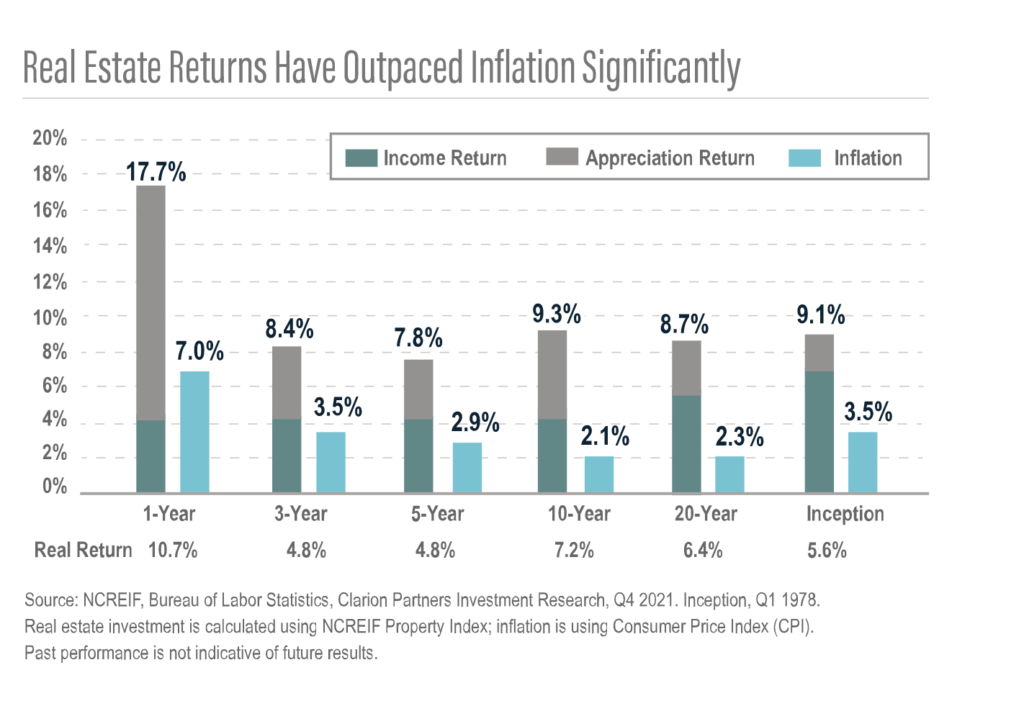

In addition, looking at Consumer price inflation, the CPI environment influenced returns, and real estate flexed into higher returns when inflation increased.

Interesting to note per Clarion , that the income from real estate remained fairly steady looking back 20+ years.

But wait a minute, is real estate a bond?

A 2015 paper by MSCI compared real estate to a bond and confirmed that while short term, it appears to be bond-like, long term, it does get exposed to macroeconomic inefficiencies.

If you hold multiple asset classes in your portfolio, the stronger correlations and growth sensitivity of real estate suggest the higher yields of private real estate are not the free lunch they might seem to be.

However, despite private real estate being inefficient and illiquid, the excess returns are worth the risk internationally.

And how does real estate produce higher coupons now?

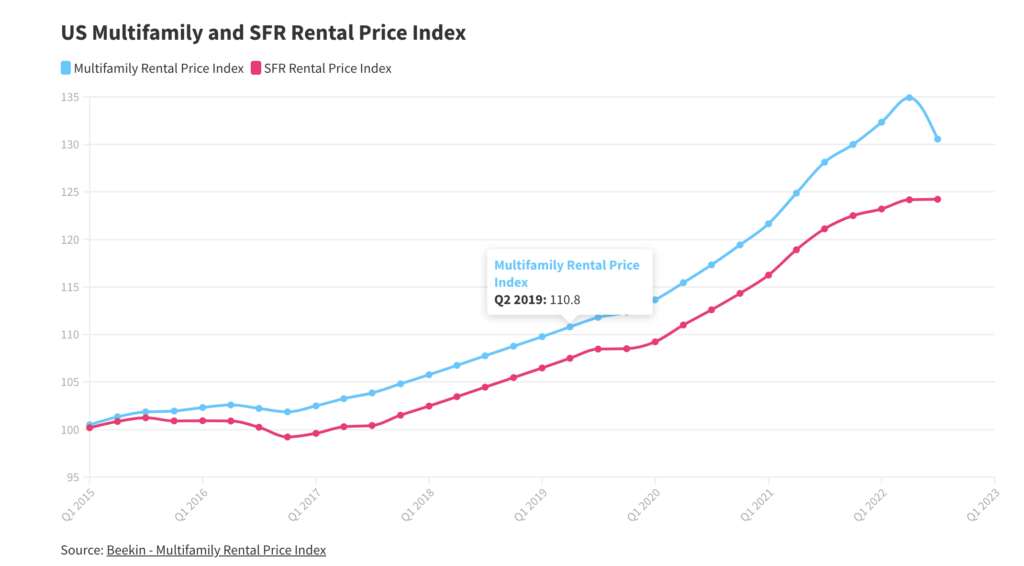

Beekin compiles recent mover indices for the entire United States. As can be seen, rents have started flatlining.

So will prices continue to rise or stay flat? Or will the rent growth make up for the higher coupon?

As a value-add real estate operator, you may make the case for increased coupons or cash yield. Or automation and precision can drive better performance and extract alpha from your portfolios as you cut costs and trim expenses.

Either way, 6 may be the new 4.

Resources

https://www.msci.com/documents/10199/bb0f1cd9-9ade-406e-a9f9-4ef62c837289