We have put together some changes to the strategy tab, looking to save you time and effort, and to provide some valuable information on what the strategies really mean.

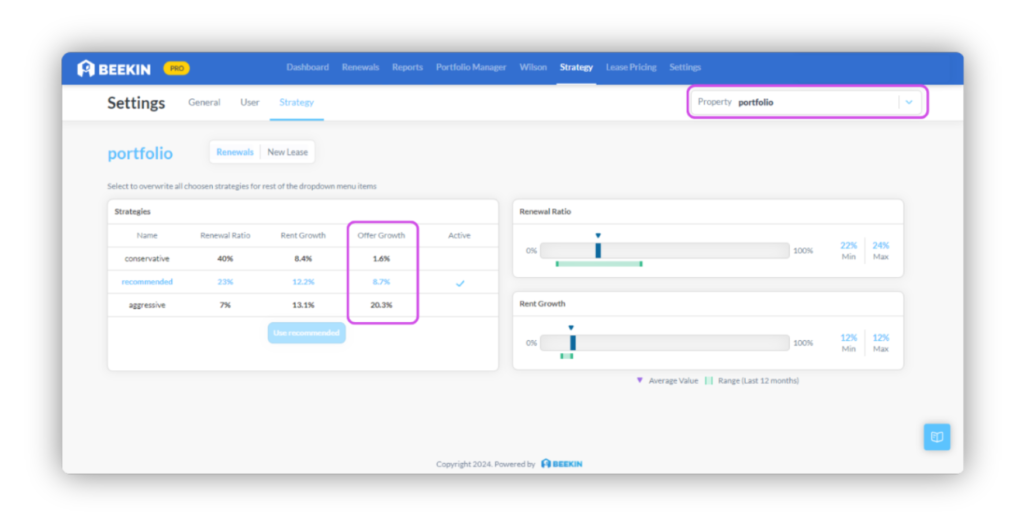

Offer Growth

We have provided additional info on the strategies tab, giving you a view of the actual offer growth. This will always be greater for aggressive and less for conservative, and represents the average increase in any offers for renewals, and the average increase versus the market rent for new lease.

For clarity, the ‘rent growth’ represents the amount we expect your portfolio rent to increase by in the next 90 days, factoring in any units that are expected to turn under the given strategy, while offer growth is the actual increase in renewal offers.

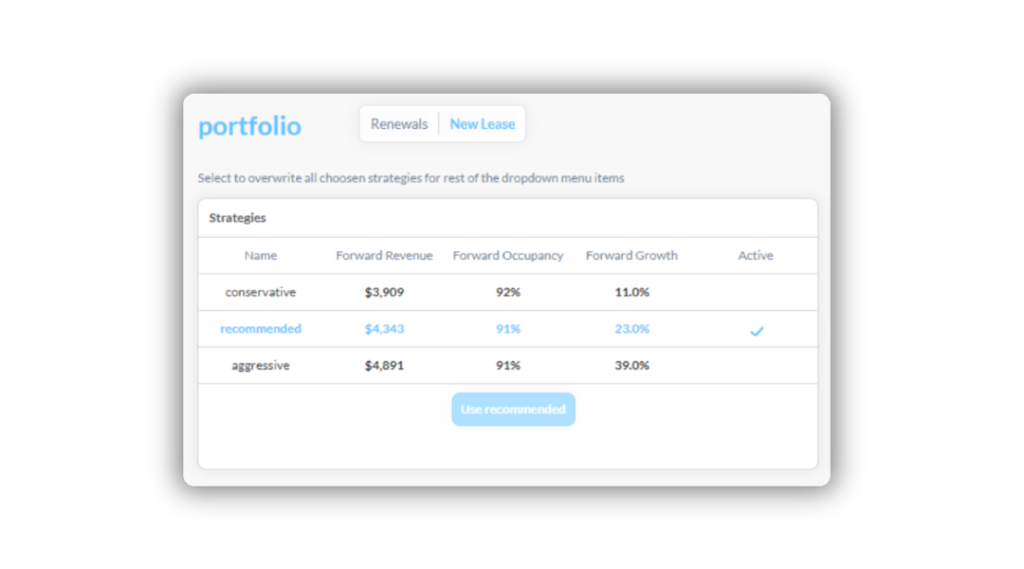

Forward Revenue

For new lease, the forward revenue is the expected average rental value for the next 90 days. The forward growth is the expected increase versus the market rent.

Portfolio Level Strategies

And when it comes to operations, you are able to set ‘portfolio’ level strategies. If you would like to set strategies for all of your properties, please select this option, and the strategy you select after will be applied to everything. You can then go back and edit any specific properties that need their own strategies, but this will help prevent any missed sites and save a bit of valuable time.

Stickiness info in renewals excel

We’ve also provided some information on stickiness levels in the renewals and new lease pricing excel downloads. This means you’ve got just about every piece of information you might require if you take it away to review elsewhere.