How Stonebridge Achieved Double-Digit Occupancy Gains in Austin with Operational Excellence and AI

Executive Summary

In one of Austin’s most challenging rental markets in recent memory, Stonebridge Management achieved what many considered impossible: high rental occupancy growth while maintaining strong renewal rates and rent growth.

Through a combination of disciplined management practices and Beekin’s AI powered LeaseMax platform, Stonebridge’s Austin property (The Shiloh) transformed from an asset under pressure to an outperformer, demonstrating the power of innovation and operations working hand-in-hand.

Learn more!

Download case study

The Challenge: Inheriting a Tough Asset in a Tough Market

When Stonebridge Management, led by CEO Jonathan Cohen, took over The Shiloh in late 2023, they inherited far more than just a building. They stepped directly into a crisis. Poor operations by previous management had triggered a chain reaction of problems that would challenge even the most seasoned operators.

Jonathan brought with him a 25-year career in operations, leasing, and leading large management companies across the United States. Stonebridge Management was built on his belief in operational rigor paired with technological innovation.

“What we didn’t know when we took over, was that the former management company had run the Shiloh so poorly, that roughly 10% of our residents had already submitted notices to vacate. We had to rebuild occupancy and revenue in a declining market"

Jonathan, CEO of Stonebridge Management

For Stonebridge, the timing was unfortunate. Austin’s rental market was entering a prolonged downturn, with falling rents and weakening demand. The Shiloh faced a looming 10% occupancy loss and the resignation of its entire on-site team. This created a “perfect storm” of operational and market headwinds.

Market Headwinds: Austin's Rental Recession

The broader Austin market context made The Shiloh’s challenges even more daunting.

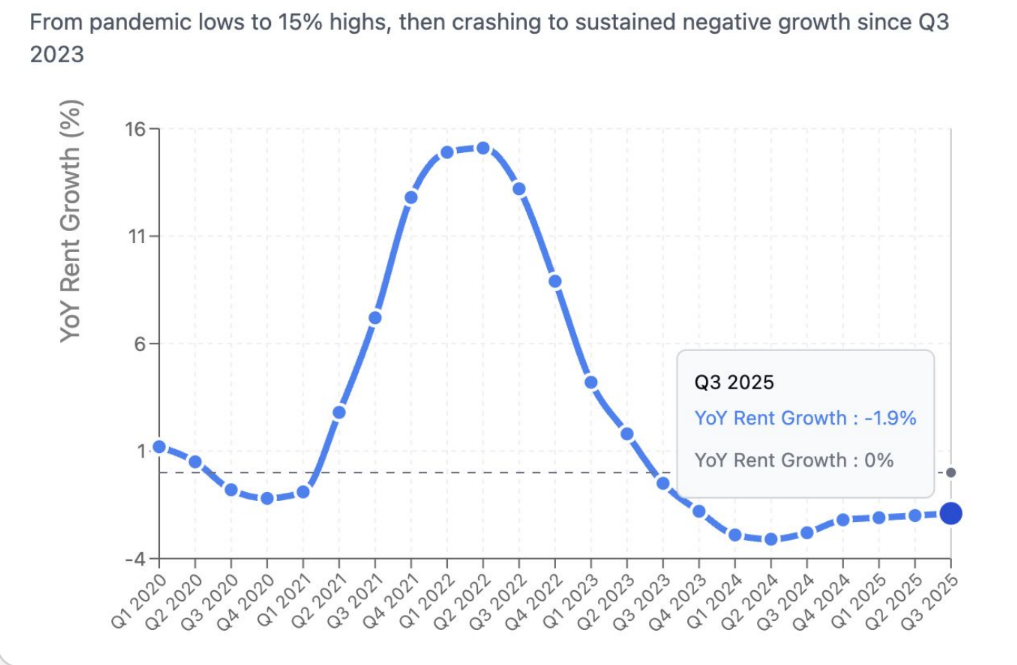

Source: Beekin same-store rental indices for Austin MSA

As shown in the chart, after a period of high demand in COVID and 2022, the market experienced consistent negative rent growth throughout 2024 and into 2025, with rent growth declining from positive territory in 2022 to negative 2-3% by 2024-2025. This represented one of the market’s most prolonged downturns in recent history. Class A properties, typically the most resilient segment, were particularly affected as new supply continued entering the market while demand remained constrained. For asset managers and property operators, this environment demanded more than traditional approaches. Standard asset management strategies—often reactive and based on limited data sets—were proving insufficient for navigating the complexity of a sustained downturn..

The Solution: Next-Generation Rental Revenue Management

Recognizing the need for sophisticated tools to navigate the challenging environment, Stonebridge partnered with Beekin AI to implement LeaseMax, an AI-powered revenue management platform that represents a fundamental evolution from traditional approaches. Unlike conventional revenue management systems that rely primarily on competitive data and occupancy thresholds, Beekin’s platform incorporates:

● 10+ years of comprehensive public data on markets, housing, demographics, neighborhoods providing deep historical context to models.

● Behavioral analytics including proprietary “stickiness” score that predicts renewal propensity of renters using Responsible AI approaches.

● Expenses integration factoring in the true cost of vacancy and lease-up.

● Advanced lease expiration management leveraging granular, unit-by-unit modeling.

● Patented optimization engine that accounts for unit variations and market dynamics

"Since I can’t foresee the future, I can only look at historical information and trends. However, I often rely on third party technology to ground those decisions in real data"

Jonathan, CEO of Stonebridge

Implementation and Revenue Management Philosophy

While technology provided the foundation, Stonebridge’s disciplined management approach proved equally critical. The company implemented rigorous operational standards while leveraging Beekin’s platform for strategic pricing decisions. Key elements of their approach included:

● Weekly pricing reviews using AI recommendations as a starting point.

● Future availability optimization for prospects looking 60-90 days ahead.

● Resident renewal strategy integration, balancing retention with revenue optimization.

● Unit type consolidation planning to improve data reliability for pricing algorithms.

"In Class A properties, prospects tend to search months in advance, whereas when you get into the B and C categories, it's typically one to two in advance," Cohen explained. "That’s where future pricing capabilities become critical."

CEO of Stonebridge Management

Results: Outperforming in a Down Market

The results speak to both the power of advanced technology and disciplined execution, as demonstrated in the comprehensive performance analytics below.

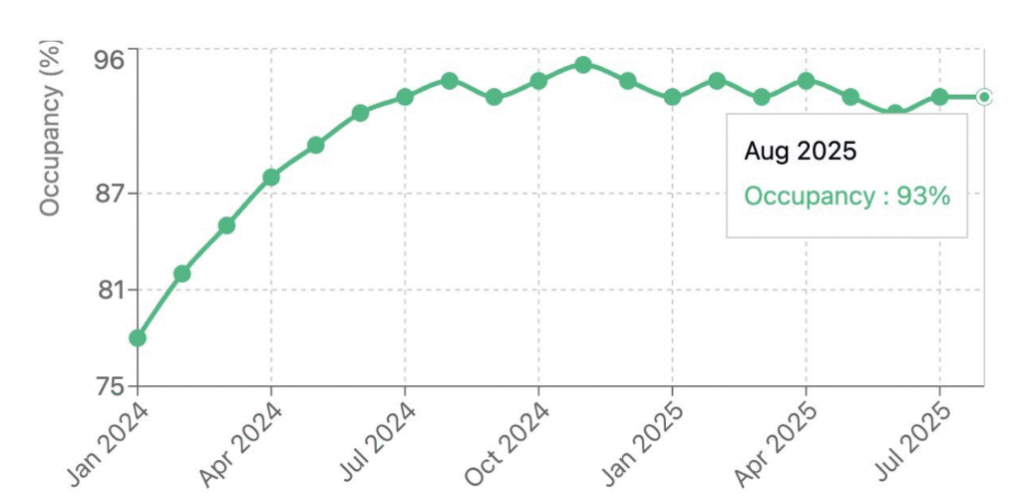

Source: Management data

Occupancy Turnaround: Not only did the occupancy rebound, but it remained high on a Sustained basis maintaining 92-94% occupancy despite market challenges with consistent upwards trajectory

Resident Renewal Performance

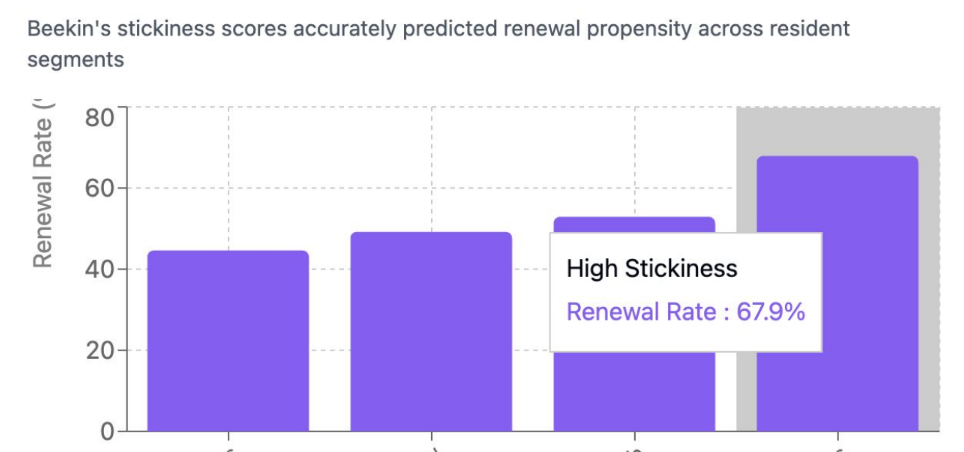

Despite implementing a conservative renewal strategy with increases of only 1-2%, The Shiloh achieved strong retention across all resident segments, by using stickiness, overlaying costs, measuring market data and staying on top of expirations.

Beekin stickiness score renewal rate prediction versus actual observed results

The chart demonstrates the remarkable precision of Beekin’s behavioral analytics and the ability to influence not just renewal price but operational decisions. This predictive accuracy enabled targeted retention strategies, boosting occupancy.

The Result: Market Outperformance

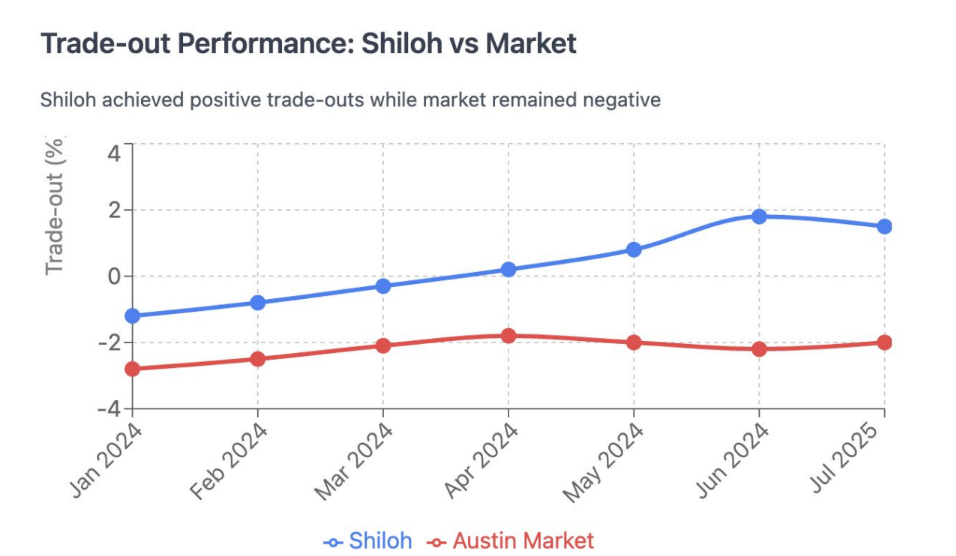

Source: Management data, Beekin same-store rental indices for Austin MSA

The chart above shows the most impressive achievement: The Shiloh not only achieved positive trade-out rents while the broader Austin market experienced negative 2.2% trade-outs, but sustained this outperformance consistently. By June 2024, the property was achieving +1.8% trade-outs compared to the market’s -2.2%, representing a 400-basis-points advantage, a remarkable achievement in a declining market that demonstrates the property’s ability to command premium pricing relative to the competitive set.

Technology Integration into Rental Occupancy Strategies: The Future of Operations and AI

The partnership highlighted several ways that advanced AI platforms can provide value beyond basic rental price optimization:

● Lease Expiration Management: The platform’s ability to generate future pricing matrices proved particularly valuable for Class A properties, where prospects typically search 2-3 months in advance for communities.

● Behavioral Intelligence: The renewal AI system provided unprecedented insight into renewal likelihood, enabling more nuanced retention strategies beyond price

● Cost Integration: Unlike traditional systems that focus purely on revenue, the platform’s incorporation of turn costs and operational expenses provided more holistic optimization, maximizing RevPAR.

● Market Intelligence: Access to comprehensive historical public data enabled better understanding of cyclical patterns, market momentum and competitor pricing dynamics.

Download the study to explore the study, access tips for asset managers & meet the future of revenue management.